Quarterly Economic Review

2Q 2018 Recap

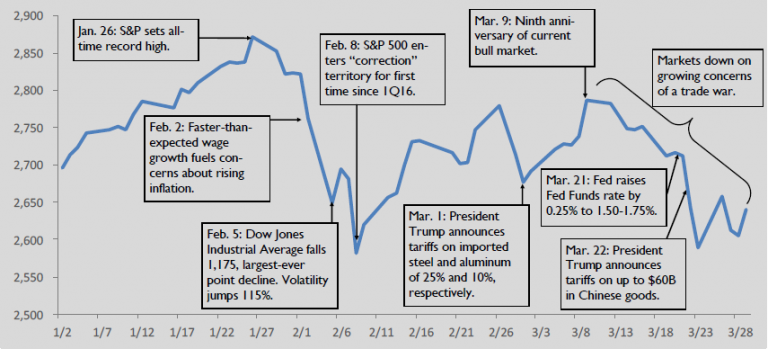

After being largely absent in 2017, volatility returned with a vengeance to start the year. Fears of higher inflation, spurred by rising rates and a surprise jump in January wage data, resulted in the S&P 500’s first correction in two years.

Volatility was further exacerbated in March when President Trump announced a series of tariffs against China. Ensuing fears of a trade war between the world’s two largest economies led to the S&P 500 retesting its correction lows of early February.

Market volatility notwithstanding, U.S. economic data continued to point towards moderate, if not accelerating, growth. Unemployment remained at a 17-year low, consumer confidence remained near all-time highs, and manufacturing data set a new recovery record, spurred by robust business spending. And while fourth-quarter GDP growth slipped from 3.2% to 2.9%, underlying details were solid, supported by strong consumer spending.

Monetary policy remained in the spotlight as Jay Powell assumed leadership at the U.S. Federal Reserve. At its March meeting, the central bank raised rates by 0.25%. Speaking afterward, Powell intimated that the Fed could raise rates a total of four times in 2018 vs. the bank’s current forecast of three rate hikes.

1Q 2018 S&P500 Chronology

Volatility returned in the first quarter resulting in the S&P 500’s first correction since 1Q16. Fears of rising inflation and higher interest rates coupled the specter of a trade war, primarily with China, drove the volatility.